Clearing and settlement

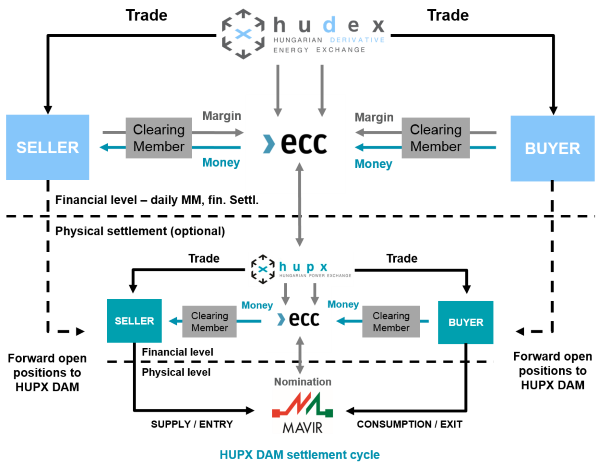

Power segment

On HUDEX Power all transactions are centrally cleared by the European Commodity Clearing AG (ECC AG). HUDEX forwards the transactions to ECC who novates all transactions, meaning it becomes a third-party in the transaction, acting as the seller to the buyers and the buyer for the sellers. Following the confirmation of the trade by ECC, the Clearing House guarantees the related financial settlement. ECC AG operates a multi-level clearing structure, where power traders become Non-clearing Members (NCMs). Non-clearing Members are entitled to trade directly on the exchange but cannot clear their own trades. For this purpose Non-clearing Members have to select a Clearing Member (CM). Clearing Members are banks or financial institutions where Non-clearing Members have to open their financial settlement accounts to provide daily financial requirements (purchase price, margins). ECC AG directly instructs the accounts of the Clearing Members who then do the same towards their Non-clearing Members.

The HUDEX members have the possibility to request physical delivery up to its open positions for weekly and monthly delivery periods. The optional physical delivery is available for those members who have HUPX DAM membership since the physical delivery of power is executed through HUPX day-ahead market. The clearing house of HUPX DAM is ECC AG who nominates the net positions to the Hungarian transmission system operator (MAVIR Zrt.) on behalf of HUPX.

For further information on clearing and settlement, please visit ECC’s website. You may find the list of eligible Clearing Members here.

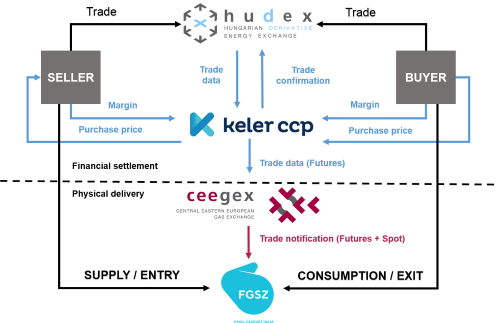

Natural gas segment

On HUDEX Gas all transactions are centrally cleared by KELER CCP Ltd. HUDEX forwards the transactions to KELER CCP who novates all transactions, meaning it becomes a third-party in the transaction, acting as the seller to the buyers and the buyer for the sellers. Following the confirmation of the trade by KELER CCP, the Clearing House guarantees the related financial settlement. KELER CCP operates a direct clearing system, meaning gas traders become Clearing Members of KELER CCP. Clearing Members open their accounts at KELER CCP's current clearing bank partners and all financial obligations (purchase price, margins) are to be met there. KELER CCP directly instructs the accounts of the Clearing Members ensuring all financial transactions are carried out smoothly.

The physical settlement is guaranteed by the TSO (FGSZ Ltd.). The trade notifications emerging from the positions of the trading participants are sent by CEEGEX to FGSZ.

For further information on clearing and settlement, please visit KELER CCP’s website.